exclusive tax and service charge

Held that a service charge could be a gratuity under. On October 31 2019 Californias First District Court of Appeal in Lauren OGrady vMerchant Exchange Productions Inc.

Oh Mexico Restaurant Miami Beach Fl

Where any payment for goods or service mentions price exclusive of tax it clearly means that the amount mentioned would be increased by the amount of taxes payable on the said goods.

. Prices Are Exclusive of 750 Sales Tax and 20 Service Charge. Please visit our State of Emergency Tax Relief page for additional information. If you wish to calculate a 5 exclusive sales tax on this product the final price would be 105.

The tax-inclusive rate would be about 23 percent which is obtained by dividing the 30. The tax will only apply to the sale of any accompanying materials and supplies and then only if either the retail value of the materials and supplies is separately stated on the bill or the value. To 1000 pm Pacific time due to.

Inclusive price 25 FB Tax 98 service charge 22 sales tax on. We have been providing individuals and businesses with expert financial and tax advice for over 20 years. About Exclusive Tax Service.

Hence in the above example if the tax-inclusive rate of. 911 Surcharge and Local Charge Rates. Tax-inclusive as the name suggests refers to that tax which is inclusive of the value of total purchase done by the consumer.

Inclusive 1 adj If a price is inclusive it includes all the charges connected with the goods or services offered. The restaurants reason out that they have a note in the menu usually in fine print stating that prices are exclusive of the 12 value added tax. About Exclusive Tax Service.

The tax-exclusive tax rate would be 30 percent as the tax is 30 percent of the pre-tax selling price. We have an Investment Committee that brings. Additional sales taxes are instead charged at.

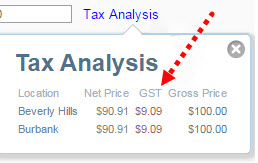

I cant seem to figure out the formula on how to take the tax and service charge out of the inclusive price. If the VAT rate is 10 the tax inclusive price of an item may be 110 while the tax. To calculate GST and Service Charge based on subtotal.

If a price is inclusiveof postage and packing it includes the charge for this. We charge you the State Cost Recovery Charge as a percentage-based. This means that the listed price is not the final cost.

More often than not the price of products and services is exclusive of tax. 72 usd per person per night. Businesses impacted by recent California fires may qualify for extensions tax relief and more.

RECEPTION MENUS Light Selection Minimum Number of Guests 25 International and Domestic Cheese Display. GST Calculator Service Charge Calculator. Whereas if youre opting for a 5 inclusive sales tax the amount of this bottle before sales tax.

Credit card services may experience short delays in service on Wednesday October 26 from 700 pm.

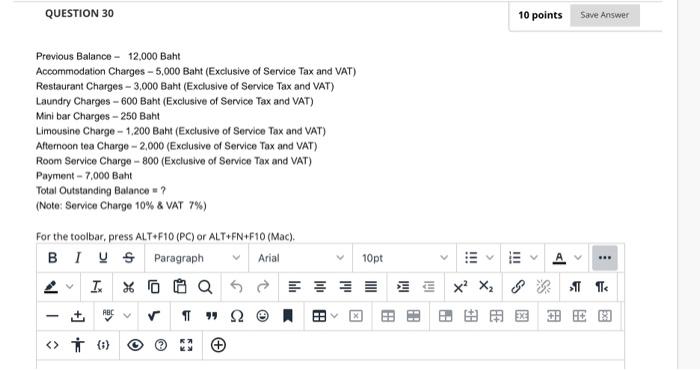

Solved Question 30 10 Points Save Answer Previous Balance Chegg Com

Birthday Party At Fairytale Island In Bay Ridge

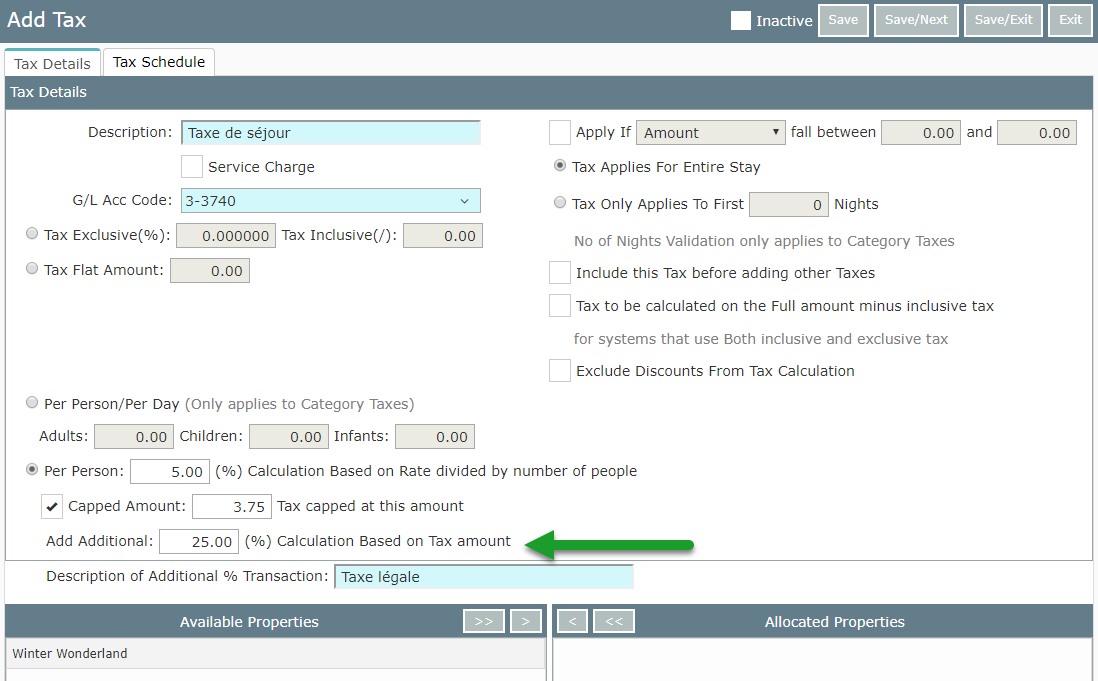

Ifc Post Exclusive Tax As Itemizer Application Setting

Choose Between Tax Exclusive And Tax Inclusive Prices Manager

Club Redwater Flyer 12 10 18 Firerock Grille

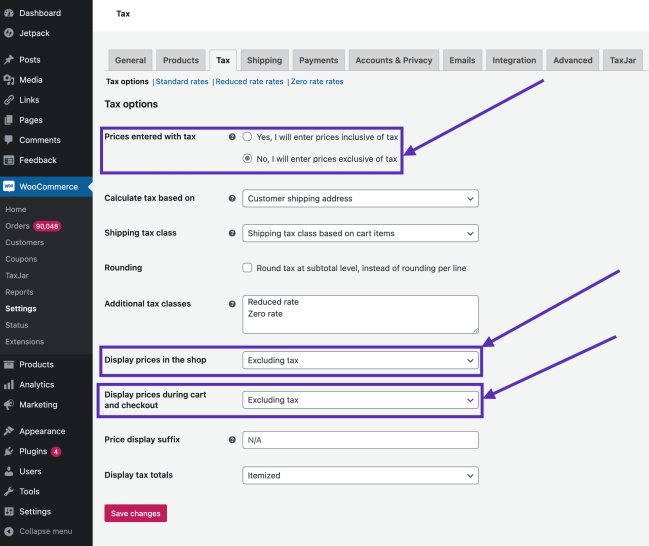

Setting Up Taxes In Woocommerce Woocommerce

Consistent Pricing Chargebee Help Center

What Does Tax Inclusive Mean And How Does It Affect You The Handy Tax Guy

Tax Inclusive Pricing Vat Or Gst

Prices Are Subjected To Service Charge And Tax Some People Juggle Geese

M D Pescheria Mdpescheriaew Twitter

Tax Inclusive Pricing Vat Or Gst

Arnaud S Menu In New Orleans Louisiana Usa

Tax Inclusive Vs Tax Exclusive What S The Difference

Reader Comment Watch Out For 5 Discretionary Service Charge At Spg S The Westbury A Luxury Collection Hotel In Mayfair London Loyaltylobby